Introduction

The adoption of digitization has been the slowest in the financial sector for loan management or lending solutions.

The adoption of digitization has been the slowest in the financial sector for loan management or lending solutions. Now, despite switching from Excel sheets to a digital record book, lending institutions are still far from having a solution that would provide a comprehensive overview of their product performance, automate the loan processing procedures, and assess a person's ability to repay a loan in real time. A loan management system has been developed to close the gaps between a loan provider and full digitization. We shall examine what a loan management system software is, the advantages it provides, and the qualities that make it the solution to a redundant set of loan handling operations as we continue reading the post. What makes it worth reading? The loan management system software market is experiencing widespread acceptance as a result of the lightning-fast growth of digital transformation.

An explanation of loan management systems

A digital platform known as an enterprise loan management system aids lenders in automating the loan handling procedures from loan application through loan closure.

It makes it possible for credit unions, banks, payday lenders, mortgage lenders, and other financial institutions to collect and verify customer data more quickly, offer new loan products, manage the ones they already have, compute interest rates, assess a person's capacity to repay a loan, and perform other operations.

Additionally, these software packages include tools and technology packages that streamline the consumer loan process by creating reports with in-depth analytics and allowing lenders to obtain important insights more quickly and effectively.

Advantages of software for loan management systems

A corporate loan management system offers benefits in several ways. Let's explore them further.

- Human mistake is eliminated There are several computations involved in the lending environment. Depending on the borrower's qualifications and loan tenure, calculations range from the EMI percentage to the loan disbursement amount. Manually doing these computations in out-of-date loan program spreadsheets might result in errors. A loan management system is designed to handle complicated computations and provide accurate assessments nearly immediately.

- Reduces time Since there are several processes and a lot of due research to be done, managing a loan may be a time-consuming process. Using loan management software allows you to digitize all the paperwork and manual procedures, which not only automates the repetitive operations but also frees up the team's time to focus on other business-related activities.

- Digital reports A loan management system's architecture should provide automated reports that may be seen in real-time. Investors and regulatory agencies frequently request data like accounting, invoicing, and tax returns in the lending industry. These reports, which usually need to be produced in a shorter amount of time, must be entirely correct. Now, these debt management programs create reports in chosen formats quickly and with the assurance of being very accurate.

- Boost your competitiveness Lenders may process applications, allocate and monitor more loans, and have a comprehensive overview of them from the loan application stage through their processing with the use of loan processing software. With the assurance of a hacker- and error-proof system, all of this. The product and IT teams now have time to focus on new loan product releases and improving client interactions, providing them the opportunity to develop a competitive edge.

- Makes lending easy An individual only borrows money a relatively small number of times throughout their lifetime. Therefore, if consumers discover a lending institution that makes the procedure simple for them, there is a good probability that they will continue to use them. Businesses may speed up disbursal by simplifying the application procedure, automating the credibility assessment, and using digitalized loan management software to generate loans.

A loan management system's features

Most lending systems are made to be scalable. In other words, you may start with a basic AI-based KYC feature and expand your program from there to a whole loan management solution. However, when we discuss the minimal viable product (MVP) aspects of a comprehensive solution that complies with all legal requirements, it resembles something like this.

- Originating loans It is the procedure by which a borrower submits a loan application, which the lender then processes. The following feature sets should be included in this process:

- Digital KYC

- Check of credit history

- The availability of several loan kinds

- Processing and application for loans automatically

- Scalability and loan availability with cloud infrastructure

- Servicing loans Every loan kind is unique; they all have variable interest rates, terms for making payments, and levels of due diligence. Lenders can compute interest, the length of the payback period, taxes, and other factors thanks to the loan management system's service functions. It also involves collecting payments, sending out monthly statements, and sending out payment reminders.

- Collection of debt Any lending operation must have the ability to recover the money. The loan management system software should be able to send payment reminders to borrowers, compute late fines, calculate taxes on payments, and inform each borrower when payments are due. Additionally, you may incorporate third-party connectors into the program to have the payment automatically deducted from the borrower's bank account.

- Reporting A reporting and analytics function is necessary for a lending business to provide reports based on interactions with other companies and customers, analyze the profitability of certain products, and track the general course of your company. Cloud integration is the one component that aids in the development of the reporting features. Remote sales representatives may easily view and share the reports thanks to the cloud. Knowing the company category to which you belong might help you decide on the features of a loan management system. I'll elaborate a bit further.

- Startups - A lending CRM might be helpful for small lending companies that provide occasional loans. It would contain fundamental loan management capabilities including managing customer information, managing borrowers, managing analytics, managing teams, etc.

- Companies in the middle size range - They offer sophisticated loans with a variety of services and a specific client portal. Customers can participate in the process by monitoring the loan application process, payments, and remaining payback days, and even communicating with the lending company through the websites.

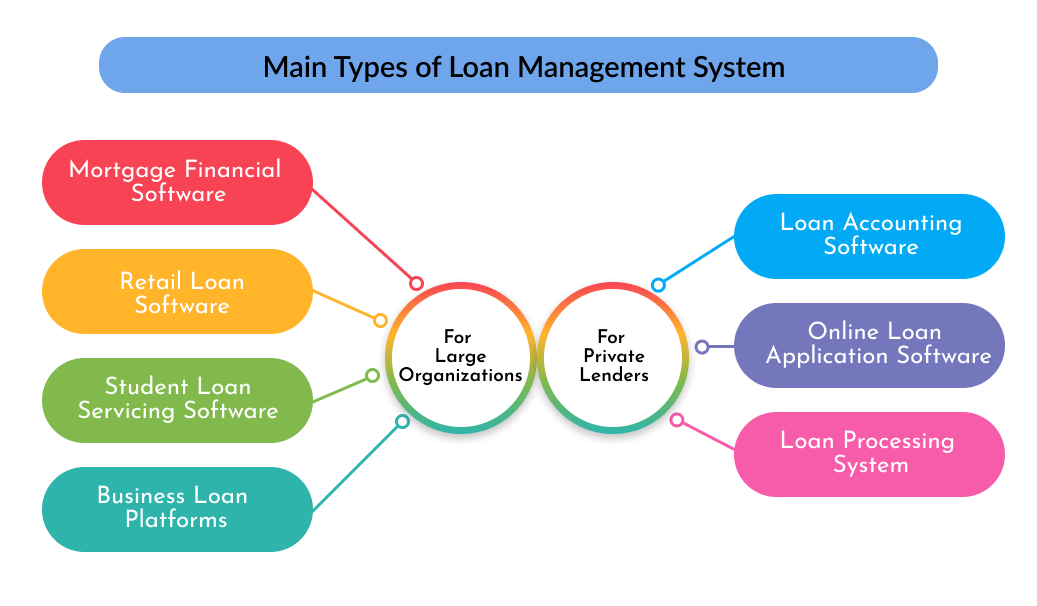

- Heavy lenders - Millions of customers are serviced by organizations like banks and private lenders. Private lenders or banks, require complete lending software, but they also need to preserve security as their top priority. To link the program with platforms like the LOS (Loan Origination System), Experian Hunter, NetBanking Connect, CIBIL, Perfios, PDF Statement Analyzer, etc., Remotestate makes sure to do so while developing financial software. With this, we have now covered a crucial aspect of creating an LMS (Loan Management System). Numerous pieces of software have entered the market based on these capabilities, enabling borrowers to participate in a simple loan procedure. Throughout, it earned a reputation as the top loan management program.

Finishing Up!

So that's all there is to know about creating a debt management system. In the end, lending companies must understand that demand for customer happiness is rising along with the popularity and use cases of the digital lending industry. It's crucial that lending companies become digital and put the needs of their clients first. We can assist. The lending systems that Remotestate's fintech developers build help businesses make better business decisions and improve customer response times. We assist lenders in meeting the demands of today's borrowers. Contact us today to begin your path toward digital lending.

Publication Date

2022-12-09

Category

Fintech

Author Name

Sajal Nehra