Introduction

Human mistake is more likely to occur when processing data manually, especially when it involves numbers. The procedure is not only time-consuming but also very costly. Robotic process automation in finance is a practical answer to the issue.

Human mistake is more likely to occur when processing data manually, especially when it involves numbers. The procedure is not only time-consuming but also very costly.

Robotic process automation in finance is a practical answer to the issue.

RPA (Robotic Process Automation) has long been used by financial organizations for their accounting and finance operations. Technology is advancing swiftly, handling data more effectively than people while saving enormous amounts of money.

According to Gartner, 80% of finance leaders have either adopted or planned to deploy robotic process automation in their business operations, which is another indicator of RPA's efficacy in the finance industry.

Given that RPA may complete up to 30 times as much work as a person, the term "hyper-automation" would be appropriate to characterize it in the banking and accounting industries. Technology has advanced from automating a few straightforward operations at a time to handling comprehensive automated reporting, data analysis, and forecasting while collaborating with other technologies.

By addressing massive, repetitive data-related chores, human resources may be used more effectively to produce more valuable results.

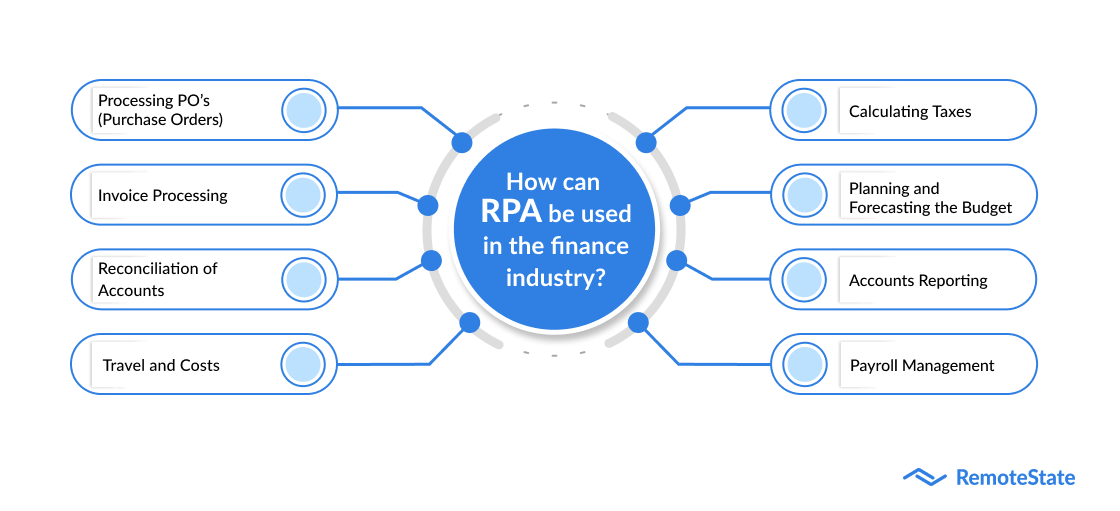

RPA’s Use in Finance Industry

Let's look at several financial RPA use cases that will undoubtedly be worthwhile for your time and money.

Processing POs (Purchase Orders)

Cash inflows and outflows are frequently strictly regulated by fintech companies.

The repetitive process of writing purchase orders for several clients, sending them, and receiving approval are tiresome and prone to error if done by hand.

AI and RPA processing the same would not only completely remove the risk of mistakes but also intelligently capture the data to produce PO’s. The automated system allows for the creation and automatic forwarding of an approval matrix for approvals without the need for human participation. Some of the most apparent advantages of RPA in finance for PO processing are that it is simple, efficient, rapid, and cost-saving.

Invoice Processing

Processing invoices is sometimes a repetitious and tiresome chore, especially if they are created or received in different forms.

Financial firms struggle to quickly raise accurate bills in client-required formats while being customer-centric organizations. Additionally, the approval matrix and procedure may result in a significant amount of rework in terms of formatting and data correction. Automation may quickly transmit the bills to the appropriate authorizing authority while taking over the time-consuming repetitive activity, assuring accuracy.

In the financial sector, accounts payable and accounts receivables may both be fully automated using an RPA. Since the machine can match the data, the maker and checker procedure may be virtually completely removed.

Reconciliation of Accounts

To make sure the balance comparisons are right, the accountant or team of accountants may need to spend a substantial amount of time on this crucial business procedure. To make sure there were no mistakes and the figures were compared precisely, back-and-forth references and logins into several systems are necessary.

To further comprehend it, consider that an organization with several activities and subsidiary businesses maintains its finances using various structures and procedures. Depending on the demands of the customer and the business requirements, it might not be possible to process them all uniformly. To reconcile the accounts of all the divisions and sub-companies, the central team, however, encounters difficulties. The procedure is arduous, prone to mistakes, and monotonous.

Travel and Costs

The accounts team spends a lot of time raising travel requests, reviewing the spending category, obtaining the necessary approval, gathering the necessary supporting papers, etc., which may even cause a delay in processing the request.

With the deployment of RPA in corporate finance, ensuring that the expenditure records are per business regulations and producing expense reports becomes simpler. Automating the procedure enables timely reimbursement management. With the use of automatic warnings, policy infractions and data inconsistencies may be brought to the attention of the relevant parties/departments.

Calculating Taxes

By automating and conducting repetitive tasks with the use of RPA bots, errors that may occur when performing the same manually are reduced. Examples of such tasks include compiling data for tax computations, producing tax basis, preparing reports, etc. To prevent discrepancies in the reconciliation and data processing, digits and numbers must be precise to the nearest decimal point.

Even though tax preparation software is used by the majority of firms, there is still a considerable amount of physical labor required. RPA bots can complete the majority of this manual labor, saving time and money while improving accuracy and compliance standards.

Planning and Forecasting the Budget

Using RPA bots to accurately retrieve information from a variety of reports and systems will assist in the creation of various reports that offer a variety of perspectives for viewing and analyzing data. Comparisons and trends may be made based on historical data and up-to-date information, which are the tried-and-true methods for forecasting and planning your organization.

Accounts Reporting

Daily monitoring of business transactions, profit, and loss enables you to plan and foresee potential problems. You avoid losses by taking a proactive approach to controlling and resolving these problems. The adjustments can be made to improve and fix the current corporate practices and procedures.

Banks and other financial organizations must provide in-depth reports that represent performance, statistics, and trends based on vast amounts of data. Manual data extraction will be laborious and unreliable. However, data collection from many sources and data in various forms is made easier with the use of robotic process automation in finance and accounting. Better forecasting and planning result from gathering, reporting, and evaluating this data.

Payroll Management

One of the most crucial procedures for every firm is payroll processing. A happier staff is created through timely and correct processing, and a happy client base and successful business are the results.

Due to the presence of financial institutions in several places throughout the world, tracking production, attendance, and taxation according to geography becomes difficult. Such data collection and computation are prone to mistakes, which might result in disgruntled workers. RPA breathes new life into the process by automating it completely. Calculations that are accurate and timely result in happier workers.

RPA bots can manage the time-consuming processes of timesheet validations, deduction computations, tax calculations, overtime payouts, etc.

Examples of Businesses Using RPA in Finance in the Real World

1. Zurich Insurance

Zurich Insurance had a hurdle in adhering to regional laws given its presence in several nations throughout the world. They were able to separate the common and general policies that could be produced by a robotic automated process with the aid of the adoption of RPA, which allowed them to save a significant amount of time. The underwriters might have enough time to examine more intricate policies. The conclusion was unexpected because they were able to cut processing costs and time by almost 50%.

2. Radius Financial Group

The mortgage application and verification procedure are time-consuming. The majority of the mortgage agent's time is spent coordinating with the customer and the mortgage company on the necessary papers. A single error made by the customer or a bank employee might cause the entire procedure to be further delayed. Implementing RPA simplifies the challenging task of looking for information from several data sources and checking it, speeding up processing by 80%. Radius Financial Group was able to sustain its business pace even throughout the challenging pandemic time thanks to the use of RPA.

3. Keybank

One of the top commercial banks, Keybank adopted RPA early on to boost productivity in a very practical way. The process of creating invoices and purchase orders, which requires several phases of repetitive work, has been automated. Even while payments are often the bank's primary concern, the automation of accounts receivable makes the payments process simple and error-free from step 1 through step 10.

Finishing Up!

Start implementing AI and ML(Machine Learning) enabled robotic process automation in finance and accounting to eliminate workflow bottlenecks and any human mistakes.

Additionally, this will aid in getting rid of the inefficiencies that result in subpar customer service. Continual repetition of boring jobs keeps workers disengaged. The following business sectors have seen a noticeable shift as a result of robotic process automation:

-

Utilize data and reports generated by RPA bots to routinely analyze client behavior and promote sustainable growth.

-

Enhance/increase the team's operational effectiveness by removing tedious jobs and delegating them to RPA bots to obtain real-time data analysis.

-

Improve the customer experience by keeping your consumers updated about different important and new aspects of your products and services.

-

Financial fraud will decrease as a result of automation, which will also proactively warn instances of possible fraud.

-

Maintain data compliance at all stages of the process.

How might Remotestate support RPA in the finance industry?

One of the fastest-growing providers of financial software, Remotestate offers RPA solutions that may easily automate your Fintech business operations. Our staff works tirelessly and enthusiastically to meet and exceed your expectations at every stage, from ideation through implementation.

Contact our specialists right away to get the ideal RPA in finance solution for your company!

Publication Date

2022-11-30

Category

Fintech

Author Name

Sajal Nehra